Today we’re talking about payday loans. You’ve probably heard of payday lending before, referred to as the quintessential predatory lenders. There’s a lot more to it than that, and we think understanding payday lending is critical to understanding consumer lending as a whole. That’s because payday loans are worse than you think they are. They’re different from typical loans, whether you’re comparing regulations, payment structures, financing costs, and more. These financial products are so disparate, we contend payday loans shouldn’t be called loans at all.

Disclaimer: this is a somewhat lengthy post. The penultimate section (roughly a third of this article) is pretty math-heavy. Ff that isn’t your cup of tea, just read the first paragraph and move on to the last section.

Before we dive into payday loans, we should define what a loan should be. Installmt made a short video on this that’s a good primer for the topic.

So how should a loan be structured?

It should be an initial, single advance of money

Borrowers should make payments in equal monthly payments

The loan should give ample time before it is fully paid back (6 months or more)

Additionally, there should be benefits to which the borrower is entitled, like:

Reporting payment history to credit bureaus

The ability to pay off the loan early without penalty

The ability to work with the lender on an alternative payment plan, should making payments become difficult for the borrower

Fixed-rate mortgages, auto loans from a dealership, and traditional installment loans are all examples of what a loan should be. There are still options in consumer finance that don’t meet these standards.

Enter: Payday Lending. Most people we talk to think that payday loans are simply short-term loans with really high interest rates. While that’s technically true, most of their characteristics are entirely different from standard loans. It’s important to understand the full context here, so we are starting with a bit of history.

Where did Payday Lending Come From?

The history of banking and lending goes far back and contains some truly fascinating stories. In the interest of time and staying on-topic, however, we’re going to skip over a lot of it.1 Let’s start in the 1970s with the formation of check-cashing services.

Here’s a tangible example to use for this: say you’re a self-employed gardener. If a client paid you via check, you could deposit it directly into your bank account. Unfortunately, it takes a few days for that money to show up in your balance, and you might need that money now. Maybe the power bill is due, or your helper for the day needs his money. Unfortunately, the bank won’t just give you that money before it shows up in their own system.

Here’s another example: again, say you’re a self-employed gardener with a check in-hand, but this time you don’t even have a bank account. What do you do?

You could take that check to a check-cashing service. The process is straightforward: they give you cash now in exchange for that check in your hand, but they keep a certain amount for themselves. These places still exist, and they typically charge a flat dollar amount. For example, Walmart charges $4 on checks up to $1,000. Nationally, the average fee for cashed checks is about 4%.

This doesn’t sound much like lending – how does this relate to payday loans?

As time went on, people began striking up special deals with check-cashers. Say you work at the McDonalds down the street and get paid on Fridays. If you need money on Tuesday for rent, you could go to the check cashing spot, give them a personal check that’s post-dated for that coming Friday and tell them not to cash it until then. The employees at the check-cashing spot are confident McDonalds will pay on time, so they are comfortable with giving you that money a few days in advance. Still, since they’re doing you a favor, they charge a bit more off the top than they normally would for a standard check-cashing deal. Instead of $4 on a $200 advance, they might charge you $6.

See where this is headed? Notice how they’re cashing a check on your “payday” in a few days? By the way, this idea of advancing money based on a post-dated check has a fancy term now: Deferred Presentment.

As time went on, this idea became more and more popular until it evolved into its own separate industry called Payday Lending. It built on the idea of advancing money for a few days to advancing money for a month or more. Then it grew into larger loans, funded by taking out money from several paychecks in the future. Lenders also realized they could charge much higher fees & interest rates or use alternative structures.

Today, it’s typical for payday lenders to require multiple checks in advance to be cashed later, with varying amounts & fees layered into the payments with a huge balloon payment at the end of the loan term. Things are much more complicated now compared to the check-cashing origins.

Payday Lending Today

Today, payday loans take on one of two structures, depending on your state’s laws and the lender you go to.

Short-Term Loan: This structure forces borrowers to pay back the entire amount of the loan within 45 days.

Longer-Term Balloon-Payment Loan: Either…

The borrower is required to pay the entirety of the loan later than 45 days from the initial advance, or

The borrower is required to make a final payment that is more than twice-as-large as any other payment.

You can find a more in-depth explanation on rules & regulations in the CFPB 1041 regulations. We should note, the CFPB regulation linked here is currently challenged in a Supreme Court case – we’ll talk about that in our next post.

An important distinction for payday lenders is they don’t check credit. They also don’t report credit. This means they won’t even look at your credit score or credit history when deciding to give you a loan. However, if you make on-time payments, your credit score doesn’t improve; the only one who benefits from that is the lender. Conversely, if you miss payments, the lender can’t report the missed payments, which otherwise would harm your credit score.

Payday loans are so different from traditional loans that state laws governing financial products completely separate loans from payday loans. In Texas, for example, payday loan products fall under chapter 393 of the finance code, whereas consumer lending (which covers all personal loans) falls under chapter 342. Some states go so far as to remove lending from the name entirely. In Texas, they’re referred to as Credit Access Businesses. In South Carolina, they are Deferred Presentment Services.

Here’s the point of this section: the government doesn’t consider these products “loans,” so why should you?

Here Comes the Math

This next section dives into a payday loan’s structure in a government-mandated disclosure from a real Credit Access Business (or “CAB,” the Texas legal name for payday lender). We demonstrate what borrowers pay in fees, where the interest rate calculations come from, and how interest compares to the total amount paid. If you aren’t interested in the math, feel free to skip to the last section, but the bottom line is this: APR interest is high because of fees, not the interest itself, and there is a big “balloon” payment in the last month of the loan term, a different amount than all of your other payments.

In many states, payday loans have a limit on interest, yet they still have the high-interest reputation. Part of this reputation is due to their short-term nature. For example, if someone loaned you $100 with the expectation you would pay $101 back in a month, 1% interest sounds pretty reasonable. The confusion comes from the APR calculation. When you average that 1% in 1 month over the course of the year, that’s just over a 12% interest rate.

Texas limits interest to 10% APR, so how do their payday lenders make money?

Additional fees, just because it’s an option. When you include the costs of additional fees, the cost of a payday loan can exceed 300% APR. There’s a lot that goes into this, so we are going to break down a payday loan financing schedule into distinct pieces to help you understand.

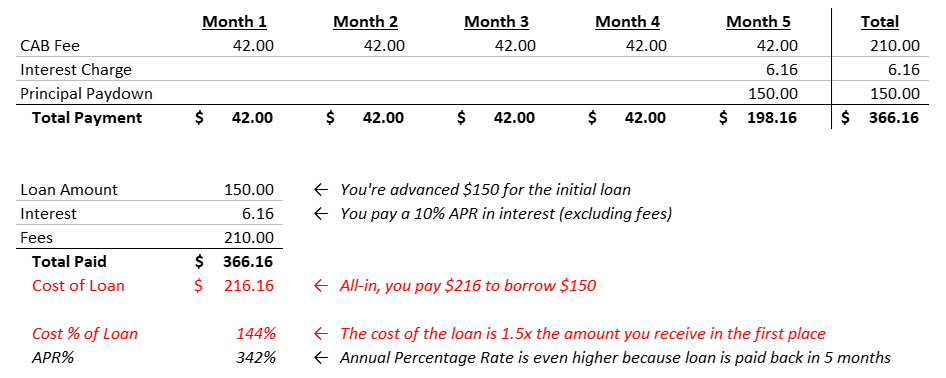

This is a fee disclosure for a Credit Access Business in Texas. It’s a legally mandated notice these businesses have to give consumers, which outlines the loan’s schedule and each payment amount. It also explains what their true APR is, which includes all costs for the loan. Solely focus on the first row (the highlighted part), which refers to a loan of $150. It also includes some Texas specific language like third-party lender & CAB fee; this has to do with specific legal structures for Texas payday lenders and isn’t important for the scope of this article.

This is a lot to digest. When we first saw this, it took us half an hour to figure out what was going on with this chart – and we have college degrees in finance. This mandated disclosure might not benefit the average consumer as much as the government thinks it does…

Here’s what’s going on:

The lender advances you $150 and tells you you have to pay it all back in 5 months.

Your interest expense is only $6.16, a 10% APR – so cheap!

However, you have to pay a monthly “fee” of $42 for the privilege of getting the loan in the first place. This is called the “CAB” fee, and it’s 28% of the loaned-out amount each month until it is fully paid back.

In month 5, you have to pay another CAB fee, the 10% interest, and the entirety of the amount you loaned out all in one go. This final payment is larger than the amount you originally received!

The third-party interest of $6.16 is 10% APR interest. But they charge outrageous “CAB Fees” just for “sourcing” the money to pay to the borrower. It’s all a way to increase interest without calling it interest.

The above chart isn’t all that helpful, and we imagine our explanation probably didn’t help all that much either. So we popped the numbers into Excel, and we think it tells a more clear story.

Each month you pay $42. In the last month, you also pay the full loaned-out amount, plus all interest that is due ($6.16). Summed up, this amounts to $366.16. This means you pay 1.5x more in interest & fees than you initially received as a loan in the first place.

We just threw a lot of numbers at you – congrats on making it through the math section! Now let’s take a step back and look at the bigger picture.

Wrapping Up

Why are we talking about this?

Payday loans are pretty much universally conflated with other, more-regulated loans, which have better terms & consumer protections. We think it’s important that people understand just how different these financial instruments are. Let’s forget, for a moment, about the outrageous cost of payday loans. Isn’t the structure of payday loans just weird? Why does it work this way? Shouldn’t all loans be more-or-less similar in structure? We think so, and we’ll talk about potential solutions in a future article.

As we wrap up, we want to caveat this sour view of payday lending with a nod to the fact that people borrow from payday lenders for a reason. Many people living paycheck-to-paycheck need cash to tie them over to the next payday, and they are just as entitled to consumer financial products as anyone else. If they have bad credit, they won’t get a loan from a bank, nor any other lender who runs a credit check. Payday lenders, who don’t check credit, are a lender of last resort, and they certainly benefit from that position. But they still give credit to people who need it.

So how do we make the system better?

We’ll explore that in future posts.

We hope you learned something from it, still. If anything, we hope you understand just how unusual, costly, and complicated payday lending is. It’s much more than a high cost loan. We will be building on these concepts in future posts. There will be a lot happening in this space in 2024, and we want you to be well-informed and understand the outcomes.

If you’re looking to dive into a rabbit-hole, the informal institution of Hawala provides an important foundation for money transfers & short-term lending from which international remittance protocols & payday lending arise. It’s a way for informal, unbanked communities to transfer money between one another much quicker than established services. Interestingly, the cryptocurrency Ripple took inspiration from the Hawala structure in designing its logic.